It is also important to note that you may have a better edge in trading if you compare multiple indicators/catalysts rather than just relying on moving averages, and that MA strategies are hard to use in sideways markets. This of course, is not financial advice and you should test these things out for yourself before taking any big risks. That way, you can avoid being out of the market for too long.

Perhaps if you're testing out moving average crossovers in real life, you could just hop on to another ticker that crossed over after a setup you were in has already played out. But, when positions were taken, the wins were often more profitable than the losses. When testing these strategies on an individual ticker, there sometimes were extended periods of time where no positions were being taken. This may be good news for investors/traders that are more risk averse. Usually, these strategies provide a lower-volatility alternative for following the trend compared to buying and holding. Trading can be a lot more complex than just following basic moving averages, but it's good to know that even something basic like this can work at times. Moving average crossover strategies aren't perfect but they are decent for trend following and can generate some good profits over time if done on the right stocks. The 11 and 49 EMA backtest was added to this article on April 4, 2021, 2 weeks after the original article was published (the backtest timing for that one will be off by about 2 weeks).

The SPY will be tested over a period of 4000 daily candles, XLF will be 5000 daily candles, AMZN will be 2000 daily candles, and GME will be 3000 15-minute candles. Each ticker will be much different than the other.

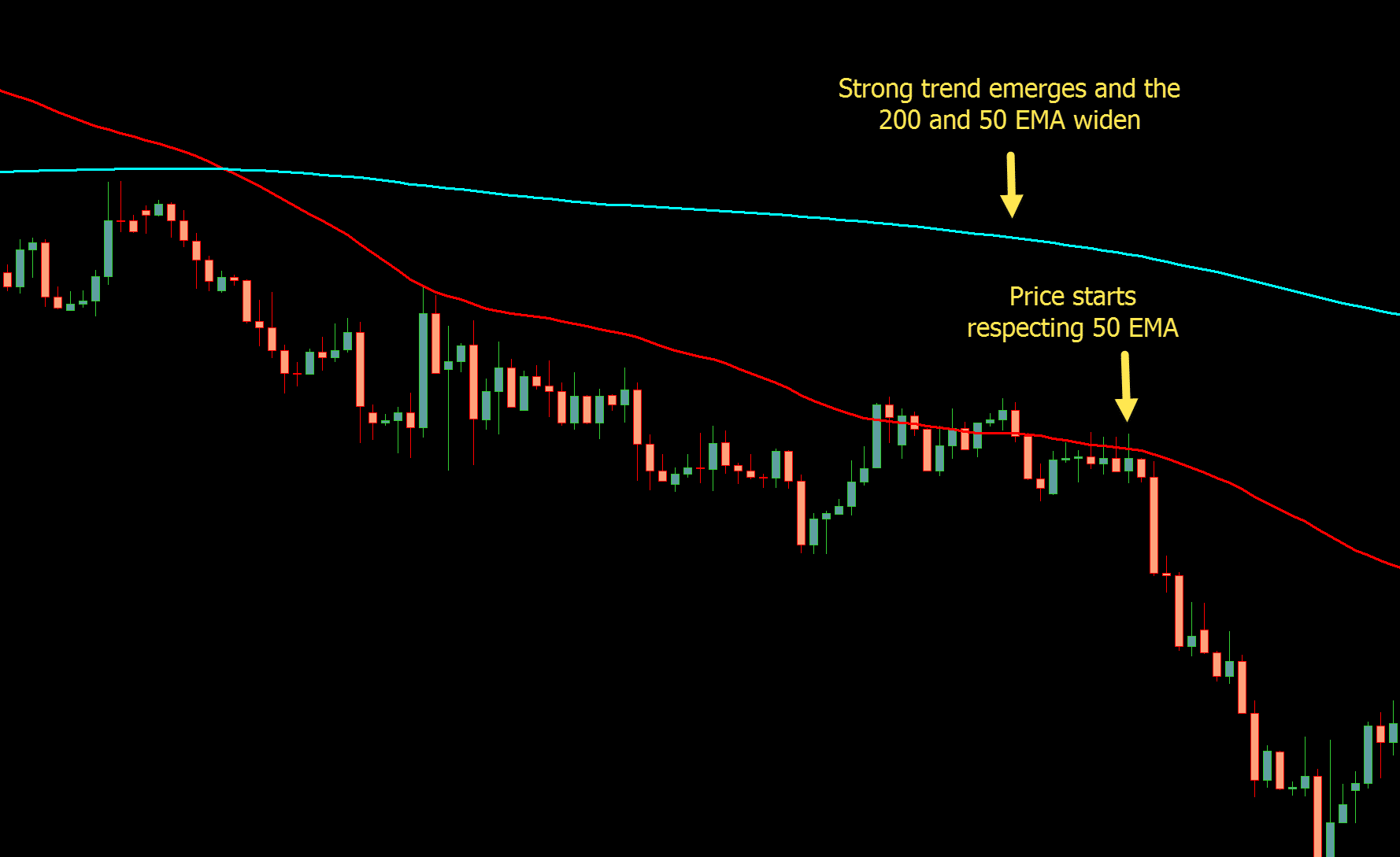

200 EMA CROSSOVER HOW TO

How to Backtest a Stock Trading Strategy - No Coding RequiredĤ tickers for each strategy. If you're unfamiliar with backtesting, check out this article here: To determine this, we'll be backtesting the strategy on 4 tickers with 5 different moving average combinations.

0 kommentar(er)

0 kommentar(er)